Revolving credit on the other hand is not a predetermined amount. The amount of the loan is set when you are approved and the sum that you borrow doesn’t change. Installment credit comes in the form of a loan that you pay back regularly (once a month, bi-weekly, whatever it may be). There are two kinds of credit: revolving credit and installment credit. The kinds of credit you use can say a lot about how you handle your finances.

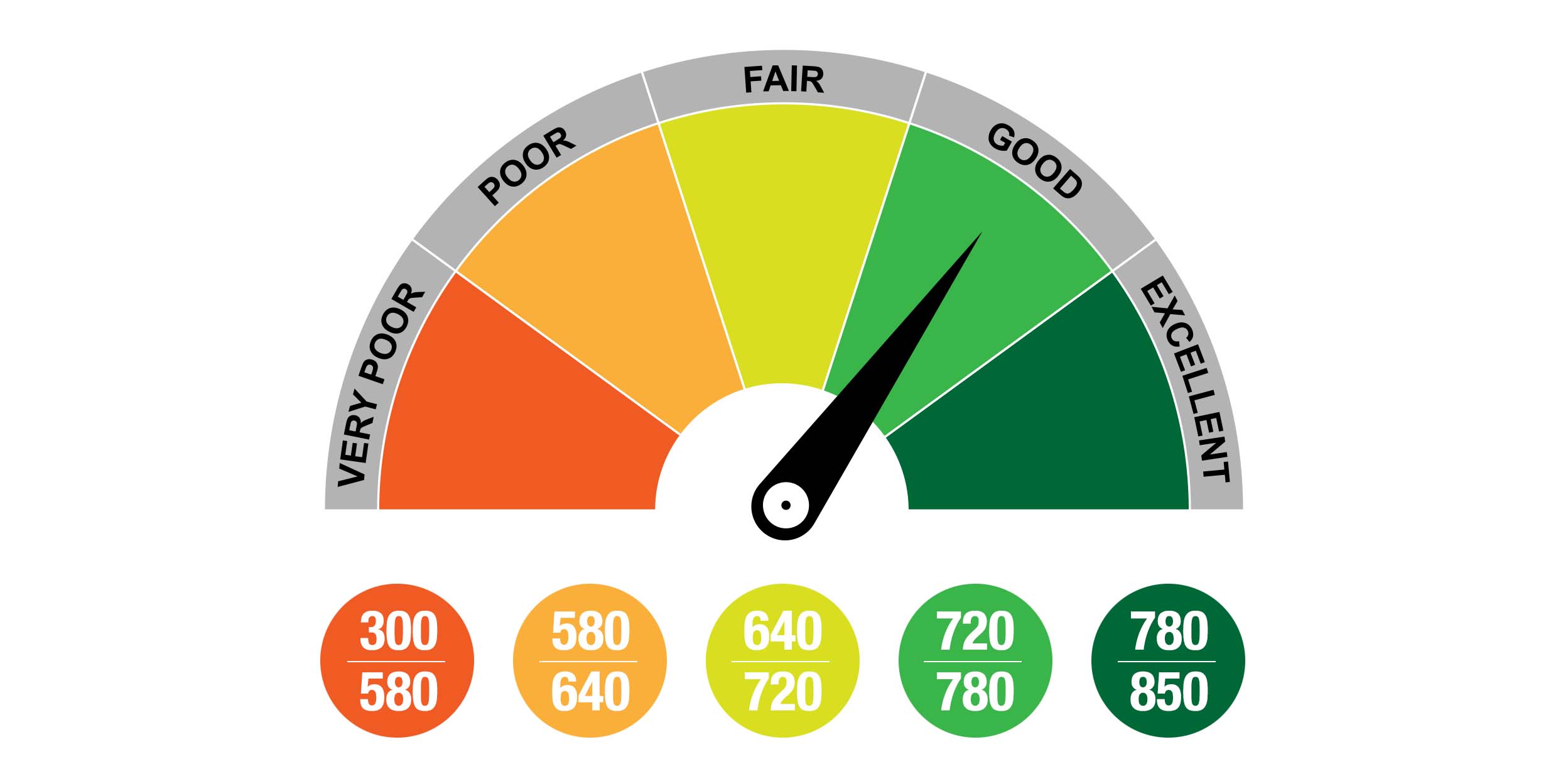

There are two kinds of credit checks: hard checks and soft checks. If you frequently sign up for new credit cards, loans or other forms of credit, lenders may conclude that you're not able to manage your money. It tends to signal financial difficulty rather than stability. How frequently are you applying for new sources of credit?įrequently applying for credit is a flag for creditors. How long has it been since you first obtained credit?Ĥ.A good credit history is built over time and that’s something you can’t lifehack. There’s nothing more frightening to them than somebody walking out of the woods with a clean slate. How much of your available credit do you use on an ongoing basis?Ĭreditors want to see a long established history of managing credit.How much in total do you currently owe?.To a creditor, that indicates that you’re struggling to pay off your existing debt.Ĭreditors will also look at how much outstanding debt you have compared to how much was available to you. Can you manage with more?īesides looking at the amount of debt that you currently have, lenders will look at what’s called debt utilization ratio: that’s the amount of credit you’re using compared to the amount that’s available to you.įor example, if you have a credit card limit of $5,000 and you’re constantly hovering at $3,600, then you’re using 75% your available credit on an ongoing basis. When creditors look at how much you owe, they’re trying to determine whether or not you are able to take on more debt. How many times have you missed a payment?.Your payment history covers all of your consumer debt: credit cards, lines of credit, student loans, car loans, cell phone payments on contract, etc. Prospective creditors want to know that you are going to pay them back. This is obviously the most important factor affecting your credit score. Most of the information is automatically removed after 6-7 years (although not purged) so that student loan payment you missed 20 years ago won’t be haunting your score today. Your credit score is calculated using five factors: In other words, a good credit score helps you save money. This is one of the ways you’ll find your credit score really matters: the better your score, the less you pay on interest. Some places might still lend you money, although at a higher interest rate. What does a low credit score mean?Ī low credit score doesn’t mean you’ll never be able to borrow. When you start hitting 625 and below, your score is getting low and you’ll start finding it more and more difficult to qualify for a loan. If your score is between 700 and 780, that’s considered a strong score and you shouldn’t have too much trouble getting approved with a great rate. If you have a score between 780 and 900, that’s excellent. In Canada, your credit score ranges from 300 to 900, 900 being a perfect score.

It can affect your eligibility for certain loans or credit cards as well as the interest rate you get. Your credit score is used by lenders to determine what kind of borrower you are. There are simple steps people can take to improve their credit score but before we explore some of those strategies, we’re going to look at what makes a good score, how it’s calculated, where you can check yours, and why it all matters.

GOOD CREDIT SCORE FULL

Understanding debt utilization ratio and the difference between hard checks and soft checks or between revolving credit and installment credit are just a small part of the story when it comes to seeing the full picture of your credit. Part of achieving financial wellness is understanding your credit score, what it means, how it’s calculated and learning practical strategies to improve it.

0 kommentar(er)

0 kommentar(er)